On July 3, 2025, Congress passed Public Law 119-21, commonly referred to (by its supporters) as the One Big Beautiful Bill Act.

Among others, Public Law 119-21 will reduce federal SNAP payments to states and localities in several ways. The federal Supplemental Nutrition Assistance Program (SNAP) provides food benefits to low-income families to supplement their grocery budget so they can afford the nutritious food essential to health and well-being.

The new law impact SNAP by (1) freezing federal support of the Thrifty Food Plan (TFP) by eliminating future cost adjustments (beyond inflation) that determine SNAP benefit amounts; (2) expanding work requirements for able-bodied adults without dependents, thereby reducing enrollments in SNAP and lowering the amount of federal funds provided to states for the program; (3) increasing the share of SNAP administrative costs that states are responsible for, from 50% to 75%, starting in Fiscal Year 2027; and (4) implementing state-level matching requirements for benefits, requiring states to contribute to the cost of SNAP benefits based on their payment error rates, ranging from 0% to 15% starting in FY2028.

Based on its current error rate, Virginia’s ‘matching requirement’ (or the reduction in federal funding to be offset by state funding) is estimated to be around 176.8 million dollars per year. In addition, it is estimated that 31,000 Virginia families will lose some or all of their SNAP benefits because of the expanded work requirements.

Impact on Fairfax County

The federal law will have a major impact on Fairfax County and Virginia. Statewide, 445,807 Virginia households rely on SNAP benefits, which helps to put food on the table for 867,192 Virginians. The law’s impact on Fairfax County will be considerable, as Fairfax County has more SNAP beneficiaries than any other county or city in the Commonwealth.

Currently, 55,863 Fairfax County residents benefit from the food and nutrition program, with an average benefit of $175 dollars per person per month. The total annual federal funding for SNAP benefits provided to Fairfax County currently equals $117.3 million dollars per year. Close to 2,000 Fairfax households may lose some or all of their SNAP benefits as a result of Public Law 119-21.

To the extent that Public Law 119-21 hollows out SNAP benefits by creating hurdles to access and lowering the effective support provided, the law will add pressure on Fairfax County nonprofit organizations, churches, food banks, and county government to support food-insecure households.

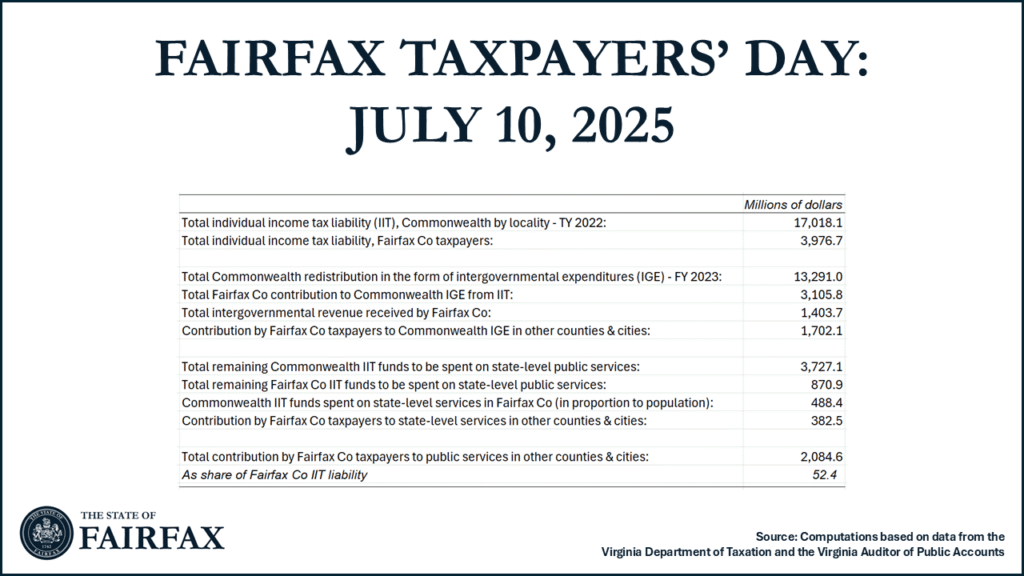

The benefits that Fairfax County residents receive from the federal program pail in comparison to the contribution that Fairfax County taxpayers make to the federal budget. Fairfax County residents contribute 16.4 billion dollars in individual income taxes to the Internal Revenue Service each year. As such, the benefits that the federal SNAP program provides to Fairfax County are less than 1 percent of the contribution that Fairfax County residents make to the federal budget.

The federal cuts to SNAP will thus further reduce–by at least 10%–the benefits that Fairfax County taxpayers get from their federal tax payments.

The impact on Virginia households

Whereas the projected impact of federal SNAP funding cuts on Fairfax County are considerable in absolute terms (as Fairfax is the most populous county in the state), the relative impact on low-income families and local communities is likely to be greater in other parts of the Commonwealth.

The relative reliance on the SNAP program is considerably greater in other parts of the state. Whereas in Fairfax County, only one out of twenty residents receives SNAP benefits (or 48 residents out of 1000), the statewide average is almost double that level (one in ten, or 98 residents per 1000). In the poorest counties and cities in the Commonwealth, more than one out of four Virginia families rely on SNAP benefits.

The indirect impact on federal SNAP funding reductions on Fairfax County taxpayers

There is another way in which the cuts in federal support will impact Fairfax County residents, as the federal funding cuts will require the state government to use additional financial resources to offset the federal funding cuts.

The irony is that many of the places that elected politicians that supported the passage of the ‘Big Bill’ are the same places that are going to be hurt the most by the reduction in federal funding for SNAP.

Then again, to the extent that the loss in federal SNAP funding will be made up by an increase in state-level funding for the program, it won’t be the residents of Appalachian Virginia or Southside Virginia who will be footing the bill.

All taxpayers in the Virginia Appalachian Region, Mountain Region and Southside combined contribute less than 10 percent of the state’s income tax revenues. By contrast, Fairfax County residents contribute close to one-quarter (23.4%) of all individual income taxes in the Commonwealth.

In order to offset the loss in federal SNAP funding in the Big Bill, Fairfax County taxpayers will have to pay 41.3 million dollars more in state taxes–or will end up receiving 41.3 million less in state services. Of the state tax increase effectively imposed on Fairfax County residents by the Big Bill for additional SNAP funding, 71.6 percent of the additional funding raised will go to residents outside of Fairfax County.

In other words…

The reduction in federal funding for SNAP will be bad for families and taxpayers across the Commonwealth: lower-income families will receive less support to supplement their grocery budget, and fewer dollars paid by Virginians to the federal government will come back to the Commonwealth in the form of SNAP benefits to Virginia families.

And because the Commonwealth will have to (at least partially) fill the funding gap left by the federal government, Public Law 119-21 will impact the residents in Fairfax County twice: first, Fairfax County residents will be faced with greater food insecurity in their own community, and second, more of their state tax dollars will have to be directed to mitigate the food insecurity created by the federal government in the rest of the Commonwealth.