The State of Fairfax was set up in April 2025–six months ago–to share the lessons from rigorous, evidence-based analysis about ‘the state of Fairfax’ and the state of the Commonwealth. What are some of the key takeaways from the analyses that have been produced so far?

Lesson 1. Local variations in cost-of-living are often ignored, but have a major impact

Household income variations among localities in Virginia are considerable, with some of the nation’s wealthiest households being concentrated in Northern Virginia. The greater wealth in these counties is largely explained by the educational status of their residents. But variations in the cost of living are also considerable in the commonwealth. People in Fairfax pay a lot more for houses, food, and other necessities, when compared to other parts of the commonwealth. When accounting for local differences in cost-of-living, the variation in median household incomes (in real terms) among localities in Virginia is considerably less than commonly understood.

Lesson 2. Fairfax County has the largest number of SNAP recipients in the commonwealth

Once the label of ‘wealthy’ has been applied, it is easy to overlook the needs of ‘wealthy’ jurisdictions. While the rates of need in Fairfax (for instance, eligibility for SNAP or other services) are generally low, the absolute number of needy residents in Fairfax County is far greater than any other locality in Virginia. Furthermore, most social programs do not adjust their benefits levels for the considerably higher cost of living in Northern Virginia. As a result, the absolute impact of economic shocks will be larger in Fairfax compared to anywhere else in the commonwealth.

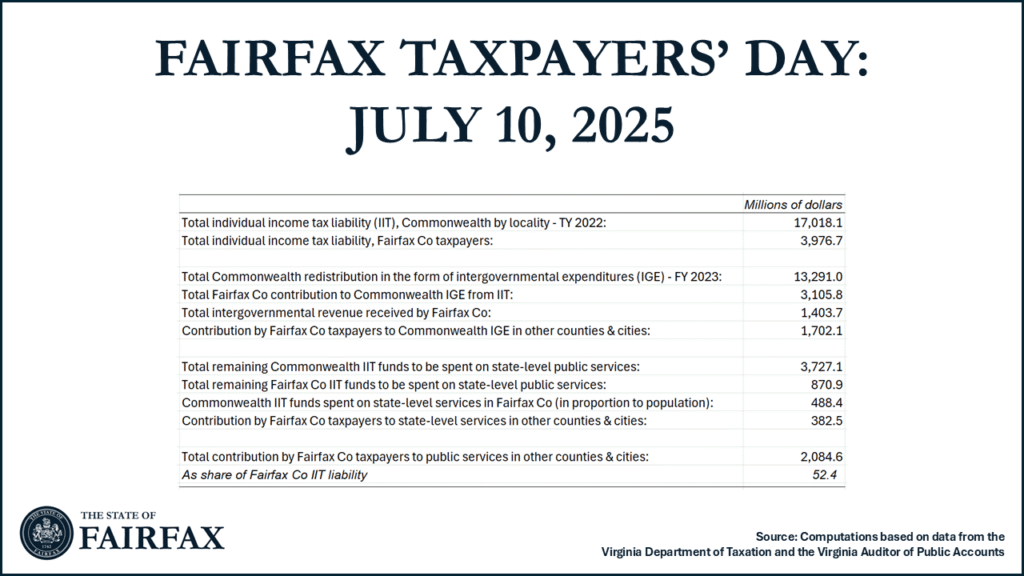

Lesson 3. Fairfax taxpayers lay golden eggs for the commonwealth

A back-of-the-envelope estimate suggests that 2.5 billion dollars in taxes paid by Fairfax County residents flows to residents of other cities and counties each year, either in the form of intergovernmental transfers, or in the form of funding for state government services to non-Fairfax residents. This represents over 2200 dollars per county resident, or more than 6000 dollars per county household. This redistribution—or the balance of payment to Richmond—represents the second-largest spending category for Fairfax County residents.

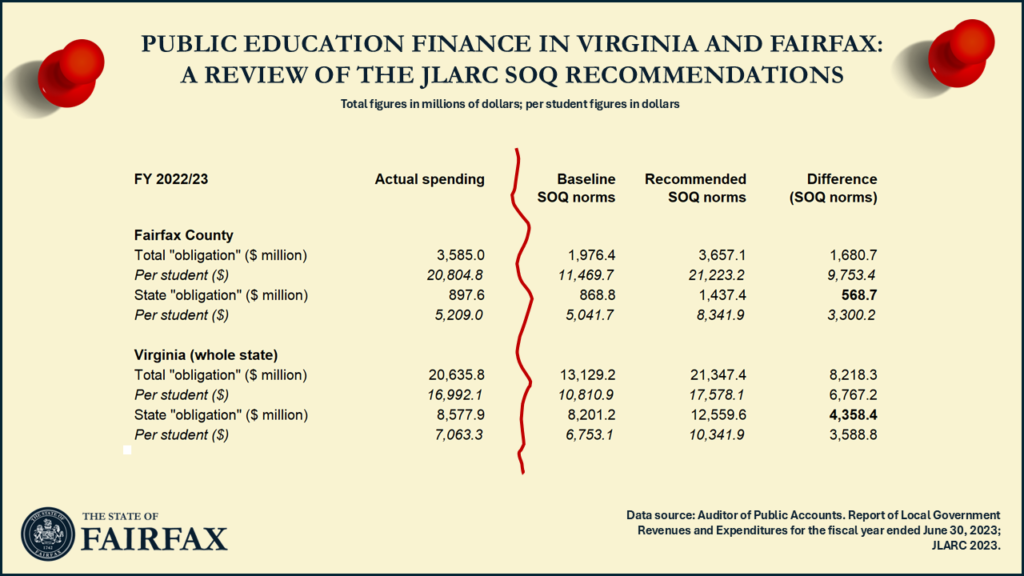

Lesson 4. When considered in real terms, Fairfax County is a high-performing, low-spending school division

When evidence is applied, Fairfax County Public Schools appear to be a relatively efficient school division. When considered in nominal terms, FCPS appears to be a high-performing, high-spending school division, but Fairfax is actually a high-performing, low-spending school division when education spending is considered in real terms. Fairfax County teacher salaries rank around 80th (out of 133 Virginia localities) when considered in real terms.

Lesson 5. Under the current SOQ formula, intergovernmental transfers flow away from Northern Virginia. Net recipients include many relatively well-performing rural school divisions

The current SOQ formula is poorly understood by many, including by those who should know better. JLARC’s 2023 review of the standards of quality used for funding public education did not come up with politically viable solutions, as its proposals focused mainly on increasing state funding, rather than focusing on the ensuring the efficient and equitable use of existing resources. Outside of Northern Virginia, smaller, rural school divisions appear to spend more per student in real terms, and consistently outperforming larger, more urban school divisions. Many of these smaller, rural school divisions appear to be receiving high levels of intergovernmental funding.

Lesson 6. The places in Virginia that most vocally oppose taxes and redistribution are among the places benefiting the most from redistribution

Not only do the places that politically oppose taxes the most already have the lowest local tax rates in Virginia, they are also among the localities that receive the greater share of funding from intergovernmental transfers. The system of intergovernmental transfers does not appear to be funding improved local public education or better local services in Fairfax or across the commonwealth – instead, the unbalanced distribution of transfers requires higher local taxes in some parts of Virginia, while allowing local governments in the more rural parts of the commonwealth to lower their local tax rates.