As a Fairfax resident and taxpayer, it is alarming when elected county and public school leaders state that Virginia public school funding has been failing students and that for decades, the Commonwealth has underfunded public schools.

Based on an analysis of state education funding done in 2023 by the Joint Legislative and Audit Review Commission (JLARC), which is the Virginia General Assembly’s nonpartisan research arm, Fairfax County Public Schools (FCPS) claims that this underfunding amounts to $568.7 million each year or the equivalent of $3,100 per pupil.

Based on the same study, the Chairman of the Fairfax County Board of Supervisors wrote Governor Youngkin that “Fairfax County is deeply committed to working with you, the [General Assembly], localities, and school divisions throughout Virginia, to ensure the JLARC study provides an opportunity for generational change in state funding for public education. There can simply be no higher priority for the Commonwealth.”

What is the crux of JLARC’s analysis and recommendations?

JLARC summarizes the current situation as follows:

“The Standards of Quality (SOQ) funding formula is how the General Assembly fulfills its constitutional obligation to seek to establish and maintain a high quality public school system. … The SOQ formula is intended to calculate the funds needed to provide a high quality education, but SOQ total funding is well below actual school division expenditures. The SOQ formula calculated school divisions needed a total of $10.7 billion in state and local funding for FY21, but divisions actually spent $17.3 billion on K–12 operations, $6.6 billion more than the funding formula indicated was needed.”

The ambition of the report—which was prepared at the direction of the General Assembly—was to recommend SOQ norms that more closely reflect the actual spending levels required to provide a high-quality education program and a fair balance of costs between the state and the localities.

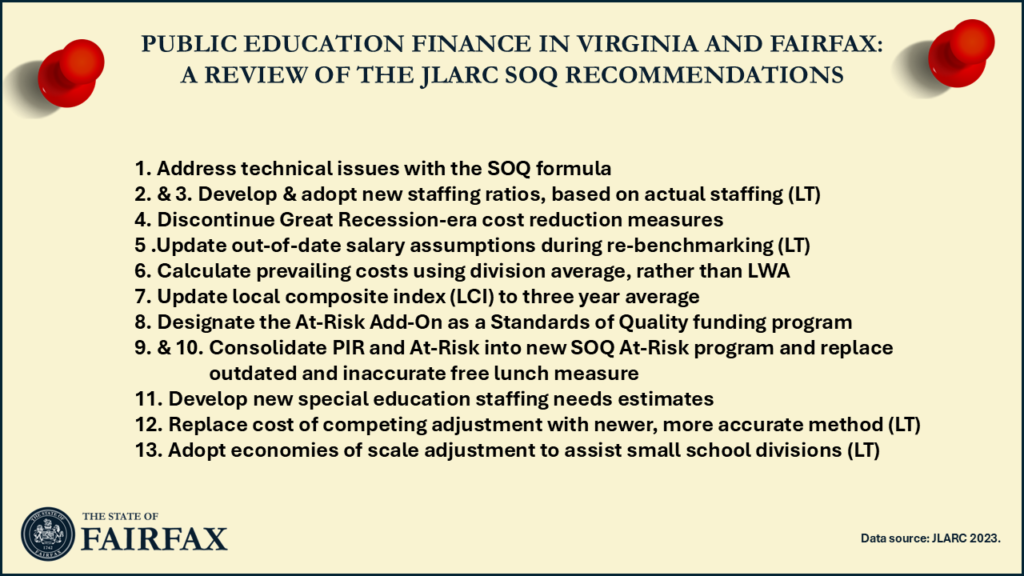

Based on the analysis of the current formula’s shortcomings, the report presents both near-term and long-term recommendations and policy options to strengthen the SOQ formula. JLARC notes that near-term recommendations could be implemented sooner, while long-term recommendations represent more complex changes that would take more time to design and implement. The report is accompanied by annexes that present detailed cost implications of its various recommendations.

Do JLARC’s policy recommendations make sense?

It is clear that considerable effort went into the preparation of the recommendations put forth by the Joint Legislative Audit and Review Commission. Many of JLARC’s recommendations are sound policy solutions to the issues that the General Assembly sought the Commission to address.

That said, the report—and its recommendations—isn’t above reproach.

Some of the Commission’s analyses and recommendations could certainly be questioned on technical grounds.[1] For instance, the recommendation to adopt an “economies of scale adjustment to assist small school divisions” is not necessarily justifiable on technical grounds. To the extent that small school divisions are inefficiently small, they have the option to overcome this disadvantage by partnering (or even merging) with surrounding school divisions. Providing inefficiently small school divisions with an additional grant would provide a fiscal incentive for these jurisdictions to remain inefficiently small. It is not necessarily clear why taxpayers in other parts of the commonwealth would be asked to subsidize school divisions that choose to remain inefficiently small.

In assessing the recommended changes to the SOQ formula, it is important to recognize that many of the Commission’s “technical” recommendations have important political or distributional implications. Whereas policy recommendations should be assessed on its technical merits, policy makers and politicians are also likely to assess each recommendation through a “political economy” lens. The political litmus test of any new or modified allocation formula is: does this recommendation give my constituents more or less funding?

What would the fiscal impact of JLARC’s recommendations be?

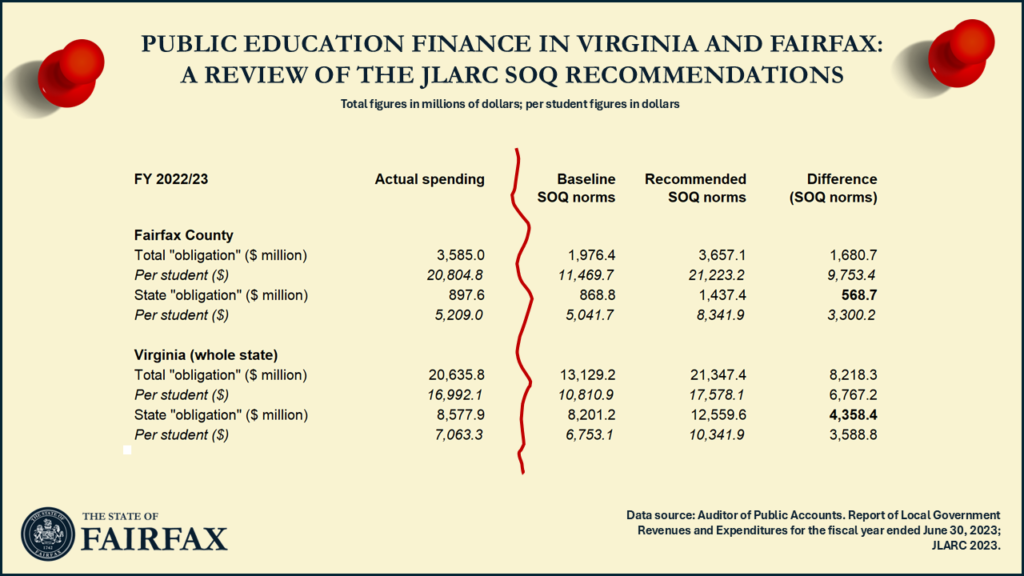

The table below shows some of the key figures presented in the reports annex, comparing the current SOQ norms (“baseline”) and the impact of all (near and long-term) recommendations, both for Fairfax County residents, as well as for the whole commonwealth. For comparative purposes, the table also presents the actual spending levels of public education for 2022/23, as presented by the Virginia Auditor of Public Accounts.

The main impact of the recommended reforms is that the total SOQ obligation (i.e., the public education spending norm) for an average Virginia public school student would increase from the current 10,811 dollars per student to 17,578 dollars per student. The new norm would be closer to the actual average spending level and closer to what the Commission deems an adequate spending level for Virginia schools.

For an average Fairfax County public school student, the total SOQ spending norm would increase from 11,470 dollars per FCPS student to 21,223 dollars per student.

It is important to note that this recommended increase in the spending norm does not mean that education spending ought to increase by ten thousand dollars per student in Fairfax County. In fact, the proposed SOQ spending norm is almost exactly the same as FCPS’s actual spending level. After all, Fairfax County has been funding FCPS—using local property taxes—at a level that is much higher than the existing (“too low”) SOQ norms.

The SOQ norms are relevant, however, because they determine the state’s contributions to local education divisions. Based on JLARC’s recommendations, the state’s SOQ obligation (i.e., the grant amounts that each county or city would receive) would increase across the board. Specifically, the amount that Fairfax County would receive for public education from Richmond would increase by 568.7 million dollars each year under the recommended formula. The total amount that Virginia localities would receive from the state as aid to public education would—as a result of JLARC’s recommendations—increase by 4.36 billion dollars to 12.6 billion dollars per year.

Whether total amount of local public education spending in Virginia actually increase as a result of JLARC’s recommendations (or by how much) depends on whether local governments hold their own spending on public education (from their own funds) steady in response to the increase in state funding. It is quite possible that many local governments would decrease their own contributions to public education as a result of the proposed increase in state funding.

It is worth pointing out that the Commission was not unaware that their projections may be misinterpreted on this point. A footnote in the JLARC annex points this out:

“[t]he Local SOQ funding change shows the estimated increase in the local governments’ SOQ funding obligation; it does not indicate how much additional funding the local government would actually need to provide. The amount of additional local funding needed would depend on how much funding the local government currently provides above the minimum required local effort. In most cases, if not all, the amount of additional local funding needed would be lower than the amount shown here. In some localities, it is possible that no additional [funding] would be needed.”

What other information should Fairfax County parents, voters, and taxpayers consider in evaluating JLARC’s recommendations?

JLARC’s recommendations are a policy proposal to the General Assembly and the Governor. The analysis further informs the public debate and offers an opportunity for Fairfax County and FCPS leaders to express their support or opposition to the proposal, or to use the recommendations as a stepping stone to alternative policy proposals. Depending on the political support they get in the General Assembly, the recommendations may or may not be enacted.

Of course, it would be great if Fairfax County were to receive 568.7 million in additional funding from Richmond for public education in Fairfax County without any additional consequences for Fairfax County families.

Unfortunately, Fairfax County residents should note a major caveat with respect to JLARC’s proposal that has gotten less attention: the JLARC proposal costs money, and an increase in government spending has to be funded somehow. Fairfax County residents and taxpayers are also Virginia residents and taxpayers.

A proper assessment of JLARC’s recommendations thus has to consider both the cost and benefit side of their recommendations. This is sometimes referred to as the “net fiscal incidence”.

As shown in the table above, the additional total cost of JLARC’s proposals is nearly 4.4 billion dollars per year. And because Farfax County is a populous and wealthy county, Fairfax County residents pay a very significant chunk of the state government’s revenues, particularly in the form of state income taxes. In fact, to be precise, Fairfax County residents pay 23.4 percent of Virginia’s income taxes. So, an increase in 4.4 billion dollars in state education spending—as recommended by JLARC—would cost Fairfax County taxpayers almost exactly one billion dollars in increased income tax payments to the commonwealth.

In other words, JLARC is proposing spending increases on public education that would cost Fairfax County taxpayers one billion dollars. As a result of the proposed reforms, Fairfax County would receive an increase of 568.7 million dollars in education funding from the state. The remainder of the increased income tax revenues contributed to the state treasury by Fairfax County residents (i.e., 450 million dollars) would be distributed as state aid to other Virginia localities in support of public education.

Should Fairfax County residents support JLARC’s recommendations?

Economists do not determine whether any specific distribution of resources to be more fair or equitable than others. That’s not part of our job. Nonetheless, economic analysis can help evaluate the economic or fiscal impact of policy options. In doing so, it is important to recognize that different residents may have different preferences when it comes to public services, taxation, and redistribution.

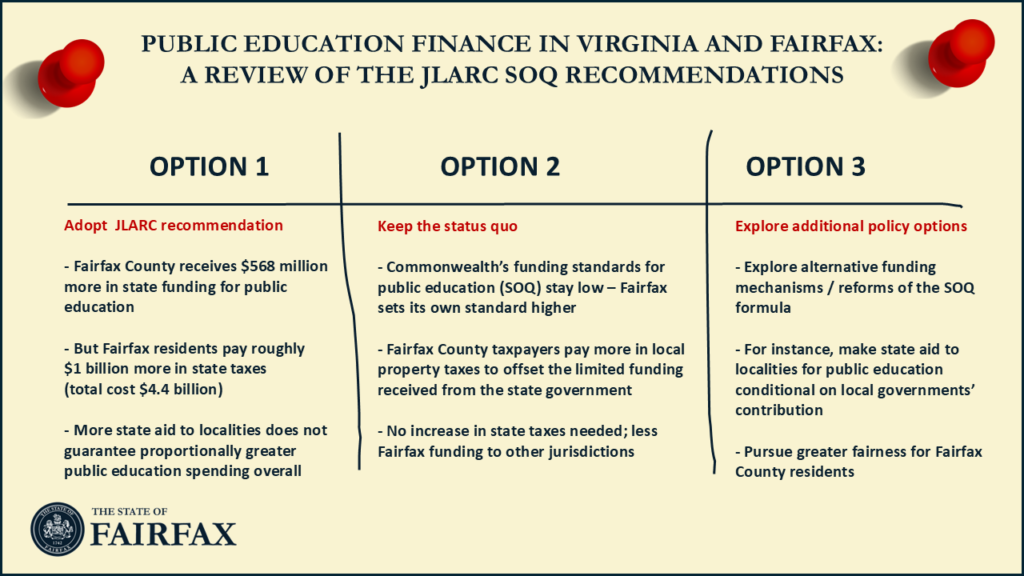

For starters, some Fairfax County voters may not care much about the quality of public education or local public services in their community. These constituents are unlikely to support any policy reform that will increase their taxes, regardless of the impact of increased tax revenue on the quality of local public services. It does not appear that this group is currently a majority of voters in Fairfax County.

At the other end of the spectrum, some Fairfax voters may care not only about the quality of public education in Fairfax, but may champion improvements in the quality of public education throughout the commonwealth. These voters might support an increase in state revenues being directed towards public education, even with the knowledge that nearly half of the additional state revenue generated in Fairfax County would end up being used to provide larger education grants to other counties and cities in Virginia. These voters are likely to support the JLARC recommendations.

A third group of Fairfax residents may land in the middle: they may be committed to high-quality public education in Fairfax County, but may be less willing—or less able to afford—to pay higher state taxes for the benefit of school children in other parts of the commonwealth. The fiscal incidence analysis suggests that if Fairfax voters care primarily about the quality of public education in Fairfax County, then the JLARC recommendations wouldn’t accomplish the outcome that these residents prefer: raising the SOQ standards (along with JLARC’s other recommendations) would cause the cost to Fairfax County residents (one billion dollars per year) to be nearly twice the direct benefit to Fairfax County ($568.7 million).

How do Fairfax County and FCPS leaders look at the numbers?

From the public record, it appears that key Fairfax County leaders generally support the recommendations made by JLARC. Fairfax County and FCPS leaders have certainly emphasized the finding that the commonwealth has been “underfunding” schools in Fairfax County.

From their public statements, however, it is unclear whether Fairfax County leaders are basing their apparent support of JLARC recommendations only on the direct benefits that the recommendations would generate for the Fairfax County government (i.e., the increase in grants), or whether their support is based on a more careful evaluation of the net fiscal incidence of the policy recommendations. Unfortunately, little or no mention is being made—either by public officials or by local media—of the cost of JLARC’s policy proposals, and the negative net fiscal incidence that the reforms would have on Fairfax County when all the costs and benefits to Fairfax County residents and taxpayers are considered.

As already noted above (and as I argued elsewhere), the proposed reforms would not necessarily have a major impact on the total amount of educational spending or on the quality of education provided to Virginia’s students. Receiving greater state funding would allow county officials to lower property tax rates while potentially keeping local education spending levels the same. Alternatively, county governments may redirect some of the additional “fiscal space” towards other local priorities, such as spending on police and fire.

It is unclear why proponents of higher SOQ standards are silent on the cost of the proposed reforms. Are they trying to win support for their political position by emphasizing the positives without mentioning the negatives? Or perhaps Fairfax County leaders have not carefully considered the net fiscal incidence of the Commission’s policy recommendations, thus failing to realize that the proposed 568.7 million dollar increase in grant funding would come with a one billion dollar price tag for their constituents?

In either case, in order to best respond to the preferences of their constituents, it is important that Fairfax County and FCPS leaders inform the policy debate surrounding education finance reforms in Virginia with accurate information and a more careful analysis of the distribution of costs and benefits that would be faced by Virginia students and taxpayers across the commonwealth.

[1] Some of the Commission’s technical discussions and claims also appear somewhat slanted. For instance, the report claims that “Virginia school divisions receive less K–12 funding per student than the 50-state average, the regional average, and three of Virginia’s five bordering states”. This statement is only true after adjusting for the cost of labor, with this caveat being noted in (very) light grey in the graph’s footnote. In reality, total expenditures per pupil in public elementary and secondary schools are higher in Virginia than in Kentucky, North Carolina, Tennessee and West Virginia, so that Virginia’s school divisions—on average—spend more per student than four out of Virginia’s five bordering states.