Last month, as a dutiful citizen, I attended the Sully District budget hearing in Fairfax County for the first time ever. Although most of us go through life without ever attending a local government budget hearing, joining a budget hearing in my own community was a bit of a personal milestone for me, since I am a public finance economist by training. Over the years, I have attended plenty of meetings with mayors and other local government officials in the United States and around the world—but I had never been to a local government meeting in my own county.

Recent global events suggested that it may be time to focus some of my skills on my own community. After all, how much do I know about how my own county government spends my rather hefty property tax payment? The answer: embarrassingly little. While both Fairfax County and the Commonwealth are very transparent—in that they provide a lot of budget data—there is almost zero analysis out there that turns the available data into information that is useful to me as a well-intended and potentially-well-informed citizen.

Public participation and freedom of speech are alive and well

It was heartening to attend the county budget hearing and to see that the community was engaged in the budget process. Middle school students and teachers advocated passionately for maintaining after-school programs. Seniors advocated for programs important to them. Taxpayers raised concerns about spending efficiency and proposed increases in tax rates. It was good to see young people exercising their freedom of assembly and speech, and it was good to see fellow residents petition their elected leaders in a civil and Norman Rockwell-esque manner.

While technically an excellent document, the presentation of the proposed county budget was lacking

The county budget hearing presented an overview of the county’s advertised budget, but the way in which the budget was presented by county officials—both during the meeting, and online—does not make a lot of sense to me as a local taxpayer, resident, or voter.

The main focus of the presentation and discussion was on the proposed increases or decreases in revenues and expenditures as proposed by county officials. As a result of the way the budget was presented, the discussions during the budget meeting largely focused on the proposed increase of property taxes (by one-and-half pennies per hundred dollars of valuation) on one hand, and the 1 percent (or so) of spending that was identified for potential reductions by county officials on the other. The spending cuts and revenue increased being discussed focused on programs that—in most cases—often dealt with “only” a few million dollars. The meeting conveniently glossed over the fact that the main additional spending “requirement” in the FY 2026 budget—equal to $240 million dollars in additional spending—is actually formed by salary increases for county employees and teachers.

Yet, at no point does the “Budget at a Glance” overview of the Fairfax County budget proposal include even the most basic overview of the total budget: how big is the county’s budget? Where is the money coming from? And where is it going? In fact, it seems like the budget presentations and documents go out of their way not to mention that the total General Fund budget of our county is over 5 billion dollars, or that all appropriated fund revenues in the FY 2026 Advertised Budget Plan total $11.68 billion. Suddenly, a few million dollars begins to sound like a rounding error.

Another surprise was that no effort was made to present the budget information in terms that is actually understandable to residents. The discussion focused on increases or decreases in revenues and spending compared to last year—in millions of dollars. Most families don’t prepare their household budgets in millions of dollars. No effort was made to present the budget in per person, per household, or per taxpayer terms.

Reddit to the rescue: what does the Fairfax County budget actually look like?

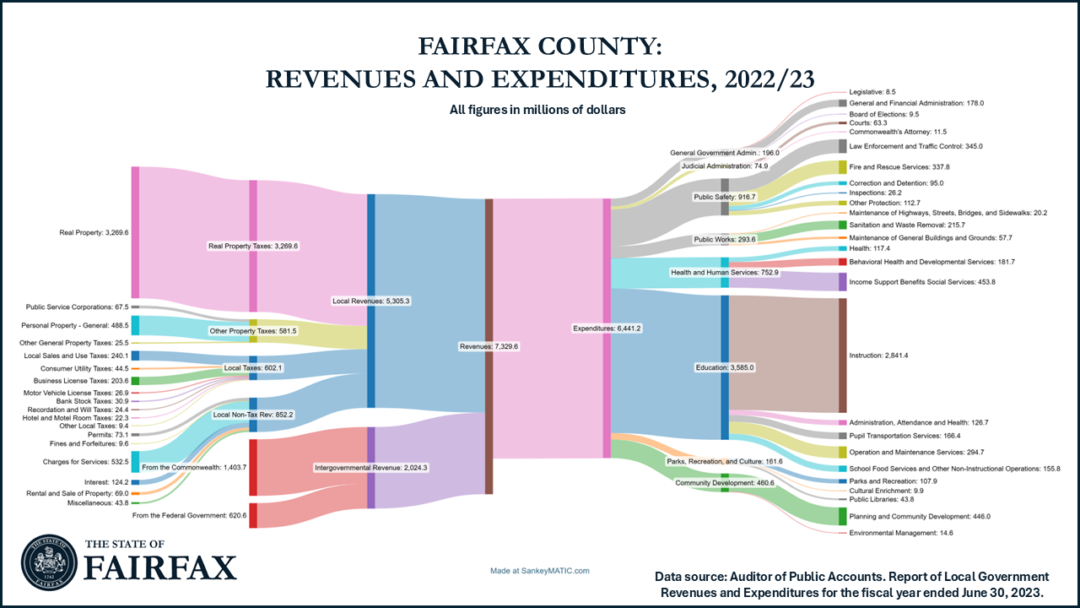

A few weeks after the budget hearing, my wife alerted me to a Sankey diagram of the Fairfax County (General Fund) budget prepared by a fellow Reddit user. While appreciative of this fellow citizen’s efforts, this graph raises an important question: how come a graph from a fellow Reddit-user is more informative than the budget documents prepared by the county’s budget department?

The Fairfax County budget: the big picture

With the intent to shed further light on the “big picture” costs and benefits provided by Fairfax County to its residents/taxpayers, I drew on figures reported by the Virginia Auditor of Public Accounts to prepare the following two overview diagrams of the Fairfax County budget (based on actual revenues and expenditures for FY 2023):

The diagrams show how local revenue is collected on the left-hand side of the graph, generally using the standard revenue categories used by the Virginia Auditor of Public Accounts (with some minor adjustments for clarity). Towards the right-hand side of the graph, the funding flows indicate how the county’s resources are spent, first by main function (e.g., education, public safety, and so on) and then by detailed local expenditure program.

A few further explanations are needed. First, the two figures look very similar, but whereas the first graph is presented in millions of dollars, the numbers in the second graph are reported in per person (or per capita) terms. This means that the numbers are (hopefully) more relatable. Rather than saying that the county raises 3,269.6 million dollars in real estate (property tax) revenues, the graph shows that an average Fairfax County resident contributed 2,869 dollars in local real estate taxes to the county budget in 2022/23. The total local revenue contribution to the county budget, on average, is 4,655 dollars per resident. On average, the county spends 5,652 dollars per county resident, of which 3,146 dollars per resident goes to education.

When expressed in per capita terms, the granular expenditure data gives a pretty good sense of the value for money provided by the county government. For instance, the county’s legislative expenditures—the cost of having an elected Board of Supervisors—is 7 dollars per resident per year. This is county democracy for the price of a single tall Frappuccino at Starbucks.

County law enforcement and fire and rescue services come in at around 300 dollars per year, each. The annual cost of the county’s public parks is less than a hundred dollars per year, which is about the same as what I spend on my National Parks Annual Pass. My contribution to the county’s public libraries—38 dollars per year—costs me less than my annual contribution to NPR—and far less than Netflix or any one of my other subscription services.

If you prefer to think in “per household terms” (rather than in per-person terms), an average household in Fairfax has around 2.7 people. This means that, on average, local taxes and other revenues paid to the county government reflect roughly 12,500 dollars per household. Total county spending is roughly equal to 15,000 dollars per household. Even when expressed in per capita or per-household terms, county taxes and county services are clearly a big-ticket item.

A second caveat that needs to be made is that while the county’s budget presentation focuses almost exclusively on Fairfax County’s General Fund (i.e., the main country government’s main budget), the figures provided by the Virginia Auditor of Public Accounts appear to report the county’s total revenues and expenditures for all county funds (i.e., not just the General Fund). This means that the numbers are somewhat larger than the General Fund account alone, and that a greater share of total funding is funded by intergovernmental revenues from the Commonwealth and the federal government (as earmarked grants tend to flow to non-general fund accounts).

Placing the Fairfax County budget in a broader context

Although the graphs above shed light on the Fairfax County budget, they only tell a partial story about the situation that Fairfax County taxpayers find themselves in. After all, while the county government is (for most of us) the government level closest to the people, it is not the only government level.

In fact, there are two innocuous looking funding flows labelled “intergovernmental revenues” that come “from the Commonwealth” and “from the federal government.” Of course, these funds are not manna from heaven. Further analysis suggests that Fairfax County residents contribute (way) more to the federal and state (or commonwealth) government then we get back in intergovernmental revenues.